Bengen S Floor Ceiling Rule

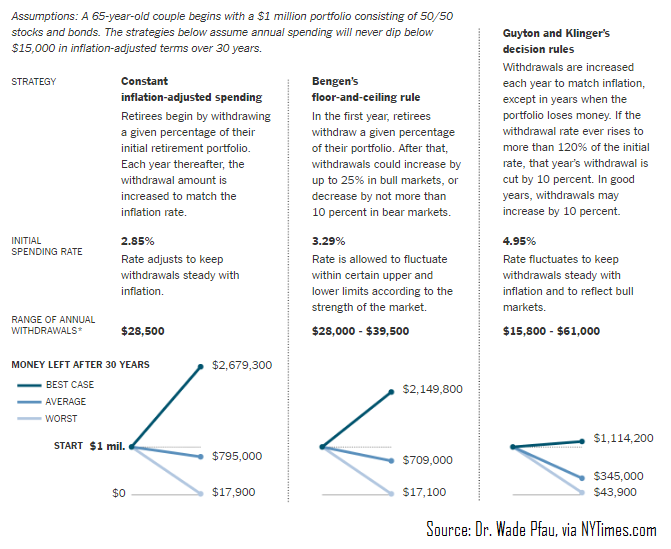

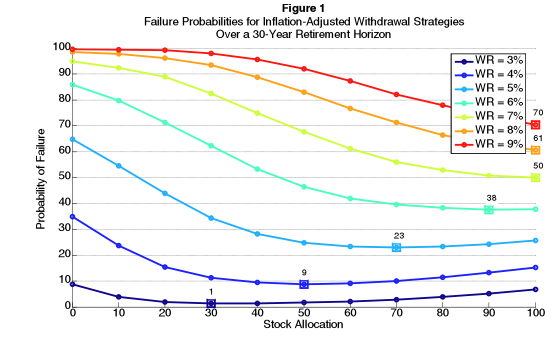

Much like the 4 percent rule the retiree would start off their retirement using some safe percentage of the initial nest egg balance as the baseline.

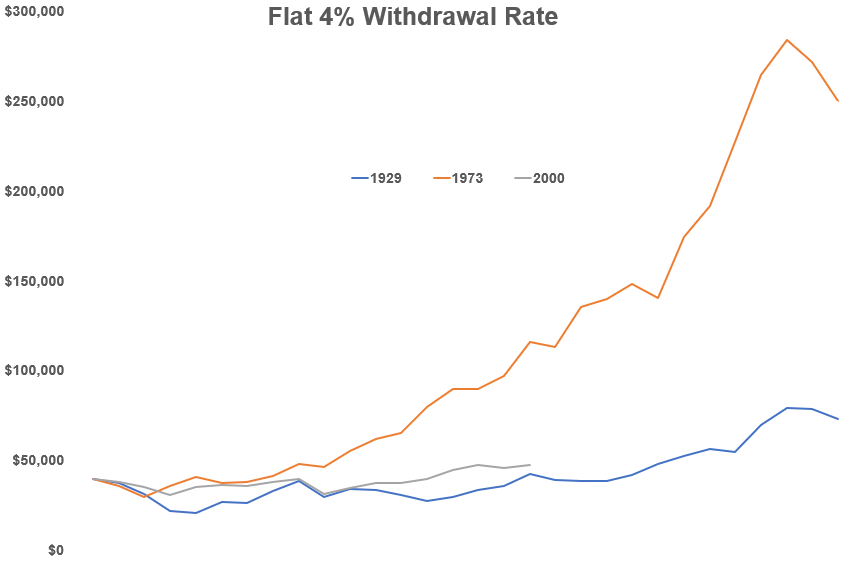

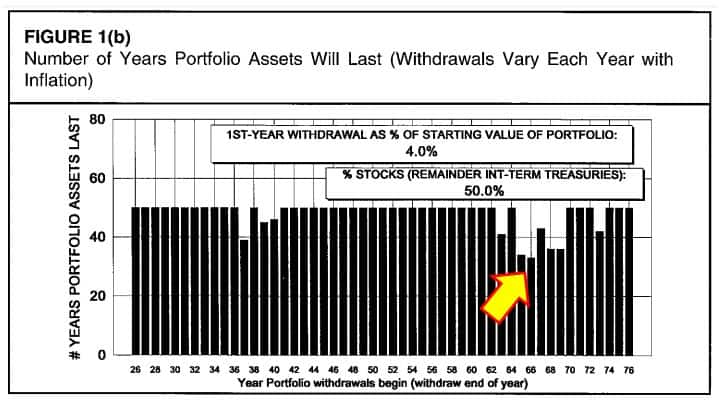

Bengen s floor ceiling rule. Bengen s hard dollar floor and ceiling rule for 4 initial spending rate 50 50 asset allocation rolling 30 year retirements using sbbi data 1926 2015 s p 500 and intermediate term government. Here s how it works. Exhibit 7 6 time path of real spending and wealth. For 4 initial spending rate 50 50 asset allocation rolling 30 year retirements.

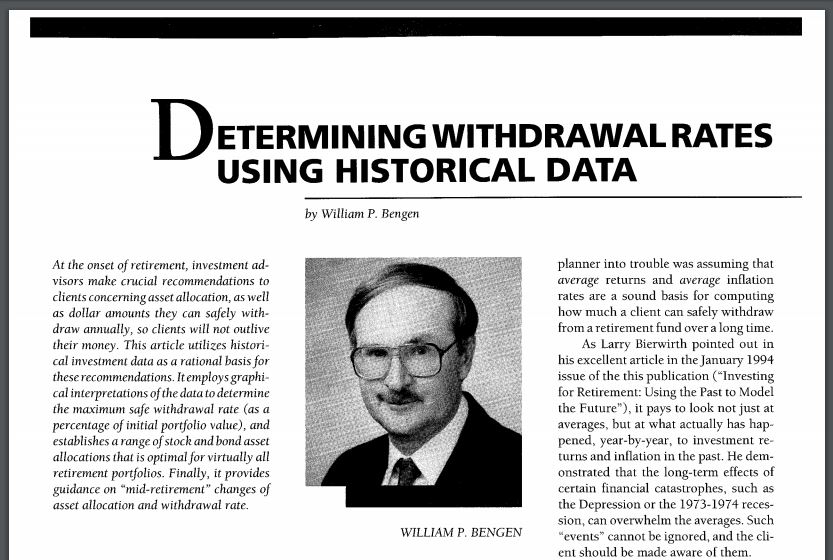

Bengen s original paper was published the 4 percent concept has been replicated expanded criticized and even refined by mr. Next read how long can retirees expect to live once they hit 65. You may be interested to know that in 2001 bengen offered a new twist to the 4 percent rule proposing an updated strategy called the floor and ceiling method. Using sbbi data 1926 2015 s p 500 and intermediate term government bonds.

Bengen s hard dollar floor and ceiling rule. The bengen floor and ceiling rule lets you spend 15 more initially at the start of retirement and then if markets don t as you expect your spending drops back to where you would be if just. Bengen is a retired financial adviser who first articulated the 4 withdrawal rate four percent rule as a rule of thumb for withdrawal rates from retirement savings in bengen 1994. By using a more diversified portfolio.

For 4 initial spending rate 50 50 asset allocation rolling 30 year retirements. Bengen s hard dollar floor and ceiling rule. For 4 initial spending rate 50 50 asset allocation rolling 30 year retirements. But he talked about a floor and ceiling approach where you spend a fixed percentage of what.

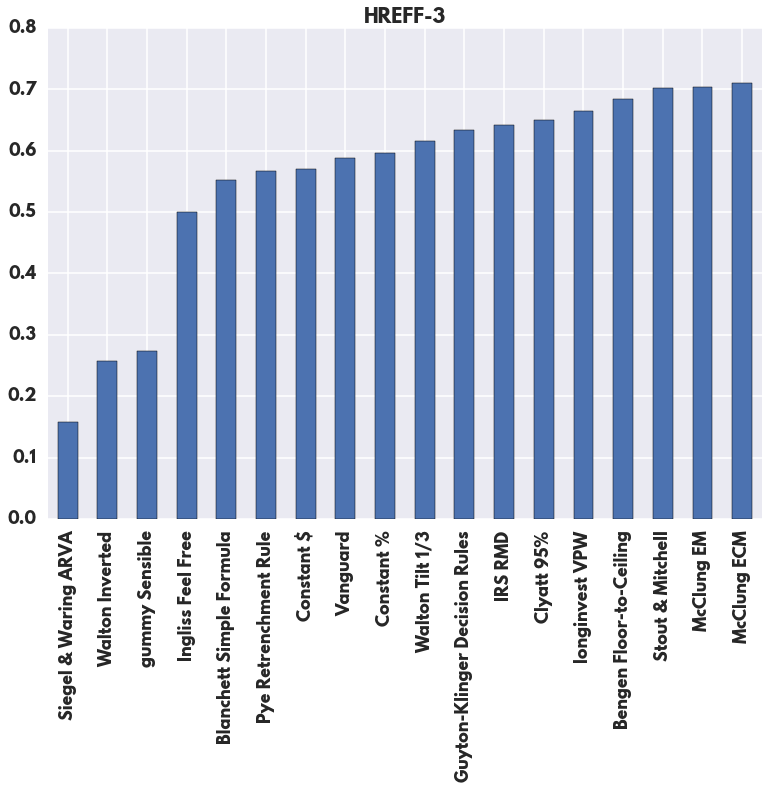

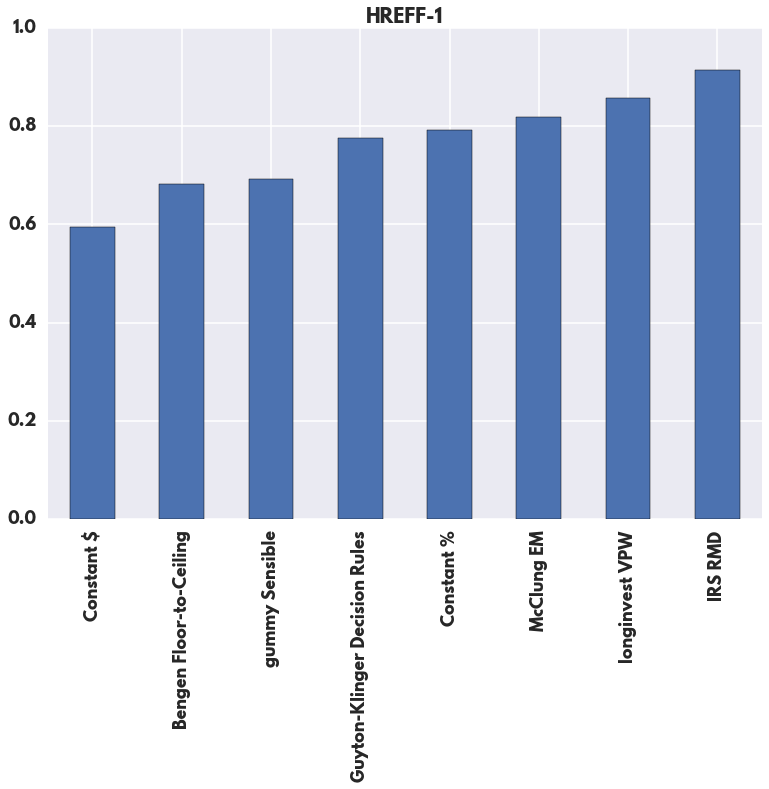

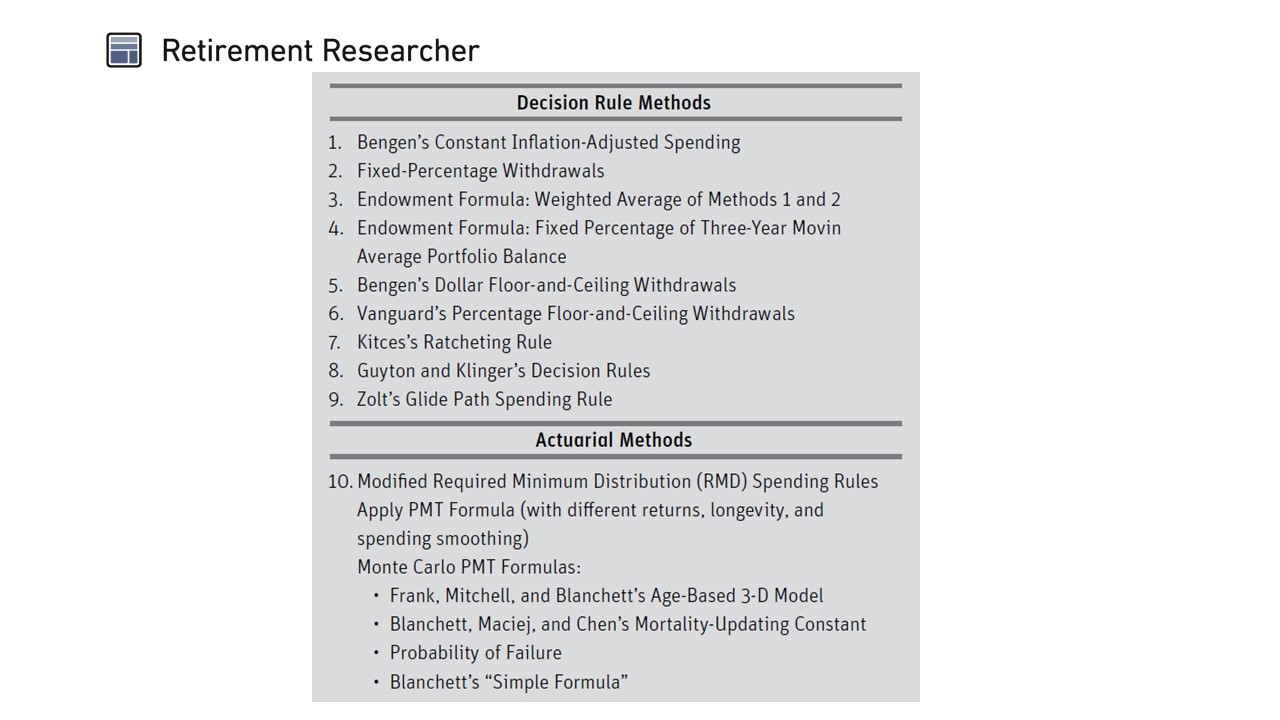

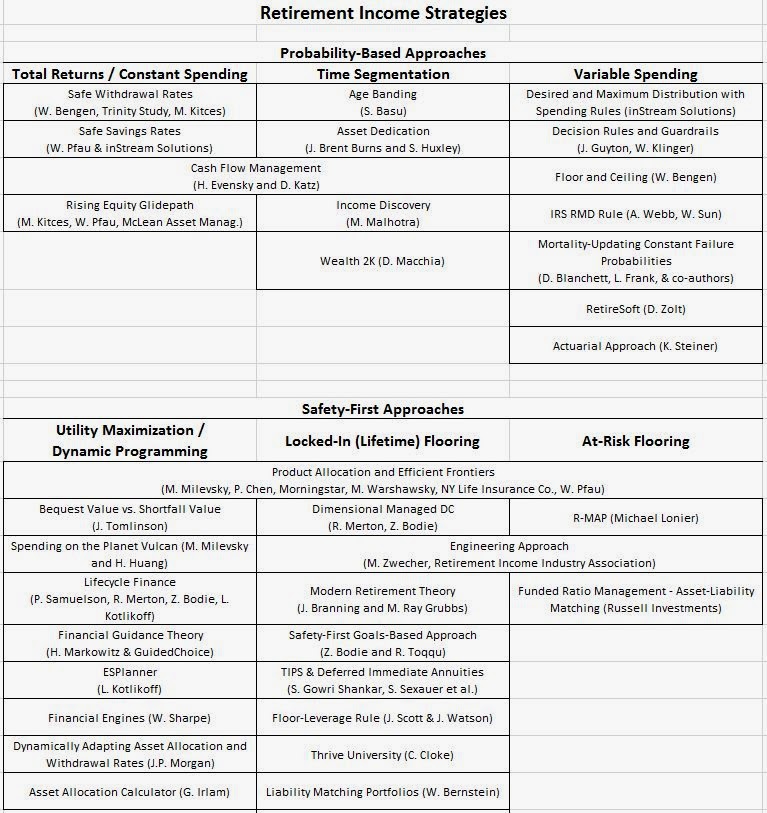

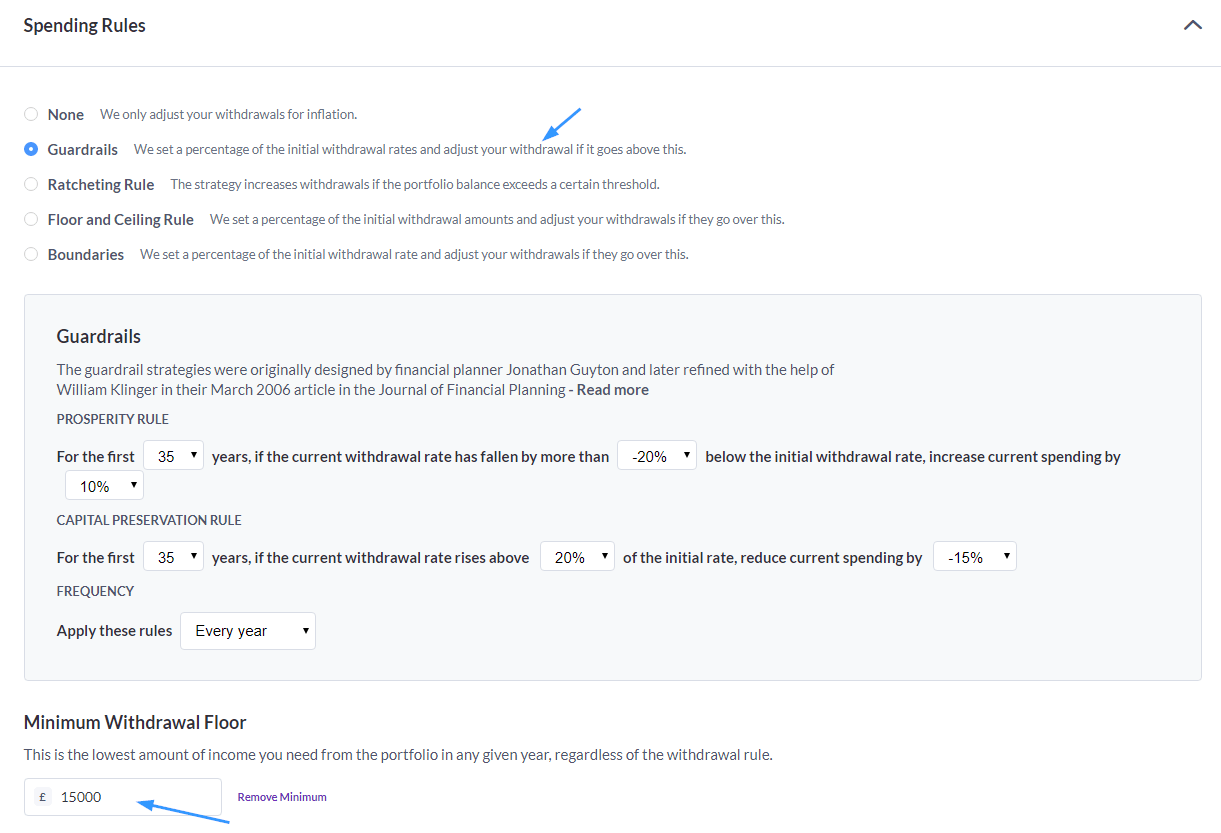

One of my favorites is actually from bill bengen and he s the one who created the 4 rule initially. It is eponymously known as the bengen rule. New dynamic adjustment methods for retirement withdrawal rates have been developed after bengen s 4 withdrawal rate was proposed. Constant inflation adjusted spending bengen s floor and ceiling rule and guyton and klinger s decision rules.

The rule was later further popularized by the trinity study 1998 based on the same data and similar analysis. More complex withdrawal strategies have also been created. Vanguard s percentage floor and ceiling rule. Using sbbi data 1926 2015 s p 500 and intermediate term government bonds.